dc vs va income tax calculator

This income tax calculator can help estimate your average income tax rate and your salary after tax. This income tax calculator can help estimate your average income tax rate and your salary after tax.

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. Virginia Income Tax Calculator 2021. The income tax rate ranges from 4 to 895. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Employers in Virginia Beach VA typically pay -141 less than employers in Washington DC. Effective total state and local tax rates on median US. Above 100 means more expensive.

Tax year starts from July 01 the year before to June 30 the current year. So the tax year 2021 will start from July 01 2020 to June 30 2021. There are lots of things to consider.

For an in-depth comparison try using our federal and state income tax calculator. Has relatively high income tax rates on a nationwide scale. BUT Maryland is one of the few states which allows countycity income taxes.

Marylands lower standard deduction extra local income tax rates bundled with higher real estate tax rates push it past Virginia as the highest taxes of the three for each income level we analyzed. It has the highest median household income at 82336 2017. Your average tax rate is.

No state-level payroll tax. Virginia taxes personal income from 2-575 depending on the taxpayers income and filing status. Virginia State Payroll Taxes.

For more information about the income tax in these states visit the Maryland and Virginia income tax pages. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100. 483 for single filers 538 for joint filers.

Taxes in Washington District of Columbia are 73 more expensive than Norfolk Virginia 100 US Average. In Virginia residents pay 858 in taxes per 100000 of assessed home. To maintain your standard of living in Washington-Arlington-Alexandria DC-VA youll need a household income of.

Income Tax Calculator 2021. Below 100 means cheaper than the US average. If you have a car parking fees.

Virginia has a progressive income tax with a top marginal rate that is slightly lower than the national average. Real property tax on median home. There are 4 different tax brackets that Virginia taxpayers are categorized within to determine their tax liability.

With four marginal tax brackets based upon taxable income payroll taxes in Virginia are progressive. Our income tax calculator calculates your federal state and local taxes based on several key inputs. For income taxes in all fifty states see the income tax by state.

Sales Tax State Local Sales Tax on Food. The virginia salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2022 and virginia state income tax rates and thresholds in 2022. Years ago DC used to have higher income tax rates than VA but as youve pointed out its pretty similar now after the last few years of reforms.

5574 for DC 6061 for. Your household income location filing status and number of personal exemptions. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Annual state and local taxes on median US. For more information about the income tax in these states visit the Virginia and District Of Columbia income tax pages.

Virginias income tax rates are as follows. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. The average sales tax in the state combining state and average local rates is the 10th-lowest in the country.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. For an in-depth comparison try using our federal and state income tax calculator. For an in-depth comparison try using our federal and state income tax calculator.

What is the income tax rate in Virginia. This is mostly due to Virginias income tax cap at 575 compared to Washington DCs highest rate of 85 for the bulk of his income. You would have to earn a salary of 42498 to maintain your current standard of living.

The local income tax rate in Washington DC is progressive and ranges from 4 to 895 while federal income tax rates range from 10 to 37 depending on your income. For income taxes in all fifty states see the income tax by state. Groceries are taxed at 25 statewide.

Since the top tax bracket begins at just 17000 in taxable income per. After a few seconds you will be provided with a full breakdown of the tax you are paying. Ad Find Recommended Virginia Tax Accountants Fast Free on Bark.

10 percent for DC 1087 percent for Virginia. If you make 97000 a year living in the region of Washington DC USA you will be taxed 14327. A single person making 101000 in income will pay 475 state income tax in Maryland unless you live somewhere else then its 65 575 in Virginia and 85 in DC.

Your average tax rate is 1198 and your marginal tax rate is 22. Your household income location filing status and number of personal exemptions. The state income tax rate in Virginia is progressive and ranges from 2 to 575 while federal income tax rates range from 10 to 37 depending on your income.

This tool compares the tax brackets for single individuals in each state. Tax rates range from 20 575. The state excise tax on regular gas in Virginia is 2620 cents per gallon which is the 32nd-lowest in the nation.

When you live in DC you will likely go outeat out more often. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. For income taxes in all fifty states see the income tax by state.

About our Cost of Living Index DID YOU KNOW. You could be looking at a positive net change in disposable income 90294 Explanation The cost of living in Virginia Beach VA is -292 lower than in Washington DC.

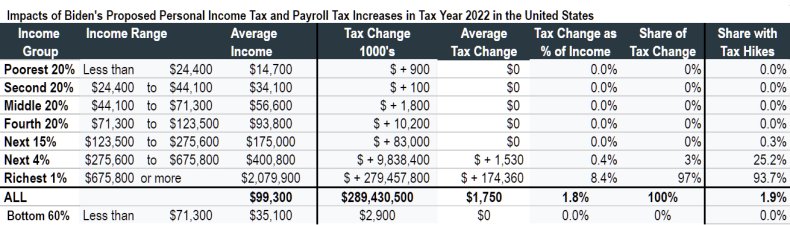

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Simple Tax Refund Calculator Or Determine If You Ll Owe

Capital Gains Tax Calculator 2022 Casaplorer

What Are Marriage Penalties And Bonuses Tax Policy Center

Hawaii Income Tax Hi State Tax Calculator Community Tax

Capital Gain Tax Calculator 2022 2021

Cryptocurrency Taxes What To Know For 2021 Money

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Virginia Income Tax Calculator Smartasset

Income Tax Calculator 2021 2022 Estimate Return Refund

A Knowledgeable Experienced Accounting Firms In Northern Virginia Our Clients Trust Us To Deliver E Mortgage Payment Calculator Accounting Services Budgeting

![]()

Virginia Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

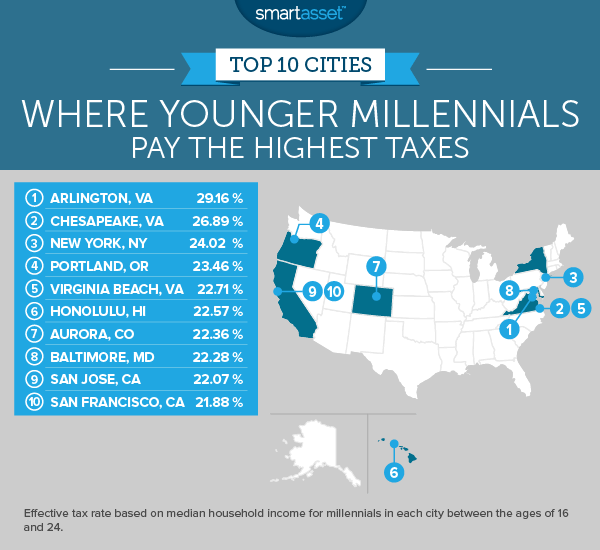

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Income Tax Calculator Estimate Your Refund In Seconds For Free

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

New Tax Law Take Home Pay Calculator For 75 000 Salary

Virginia Income Tax Calculator Smartasset

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You